The internet has always been a risky place, especially for seniors. senior people or senior citizens represent a demographic that is both compassionate and trustful. These are the characteristics, online scammers prey on. They find senior citizens to be easy targets. Thus, they try to exploit them more often.

According to records, around 6 billion dollars is lost every year to online scammers (source). Unlike young adults, senior citizens are not very up-to-date with technology. Most of them are unable to keep up with the latest technology and this makes them more vulnerable to con artists.

Senior citizens are more likely to miss the latest security upgrades. Due to their trusting nature, they easily believe any new schemes that are offered to them online. Unlike young people, they are unable to differentiate between real schemes and fraud schemes.

The rate of senior citizen scams has increased significantly in the last few years. If you want to protect yourself from online fraud, you must give this article a read. This guide will tell you how to identify online frauds and prevent them from happening to you.

What is Senior Citizen Fraud?

Senior citizen or elder fraud refers to a specific type of fraud that particularly targets older people. However, online scams can happen to anyone. Most of these scams happen over phone calls.

senior people must stay aware of these fraudulent services. These scammers are smarter than you think. They come up with new and innovative ways to cheat people.

Senior citizen fraud can happen in many ways. One of the most common ways is through emails. These scams take place with the help of links and other content that are aimed at the seniors. They mainly use health or medical-related issues to scam you. Any elder person should be aware of these phishing techniques.

Besides medical emails, they may also send mails on retirement savings, home equity, or emails for friendship. They use topics that would trigger the interest of elder people.

Other than emails, they may also target senior citizens over phone calls. They may trick you to give your bank or card details over the phone. This mostly happens in the case of lottery scams.

Reasons Why Elders Are Targeted More

You may wonder why elders are the favorite target of online scammers. Well, there is more than one reason for it. Take a look at the pointers below and you will know why.

1. Trusts Easily

Most elder people are trusting. They believe things more easily than anyone else. This makes it easier to fool them. Scammers take advantage of their trusting nature to cheat them with fraud schemes.

2. Not Tech-Savvy

Most elder people are not tech-savvy. They don’t have sufficient time to keep up with the latest technology trends. This makes them an easy target for scammers as they find them easy to fool.

3. Isolation

When you reach a certain age, you need a companion or a friend by your side. But sadly, not many elder people have such a person beside them. This triggers the feeling of isolation and out of a desperate need, they look for friends online. This often leads them to the scammer’s den.

4. Common Problems

Scammers are smart people who are very well aware of the common problems that most elder people have. They use phishing techniques with common content like health and medication costs, health care coverage, and financial security to lure senior people. They are more likely to get attracted to such schemes.

13 Prominent Types of Online Scams

It is surprising to see the number of online scams that are happening these days. According to reports, most of these schemes are carried out via email. The most common online scams are:

1. Relationship Scams

This is one of the most common scams carried out by scammers. Most elder people are lonely and look for companionship. Thus, they make an easy target for scammers. A relationship scam may involve chatting or meeting in person. All this may sound very tempting to elder people. Once you fall for this kind of trap, they will start asking for your money for some personal reason or the other.

2. Lottery Scams

Lottery scams are also quite common these days. These kinds of scams are not just aimed at elder people, but younger people also fall prey to such scams. Suddenly, you see a large pop-up claiming that you have won some random cash prize on your screen. If you see this on your screen, you know it’s a scam. The main aim of these lottery scams is to lure you to give your personal information such as bank and card details. A large number of elder people have fallen victim to these types of scams.

Report the crime to https://www.usa.gov/stop-scams-frauds. This website offers specific advice on where to report scam lottery attempts.

3. Insurance Scams

This is yet another popular type of scam carried out by scammers. It is their technique to take out money from the victim’s pocket. These type of insurance scams comes with no promises. The scammers will try to tempt you to invest in such schemes. This type of fraudulent activity has increased quite a lot these days. Some scammers will make you believe that they are licensed, insurance agents. This makes it difficult for elder people to figure out whether it is real or fraud.

4. Health Scams

Health scams are more targeted at senior citizens because they tend to consume more health and medical products than young people. If you look at the structure of these scams, you will realize that they are very gracefully designed. They look almost real and highly convincing. The scammer will create a website and invite you to buy medicines at discounted rates. These sites look so real that you will not even realize that you are getting scammed. Once you make the payment for the medical supplies, you will receive none. This is why you are recommended to buy medicines and other health equipment from known and trusted sites only.

5. Charity Scams

The next type of scam is a charity scam. In this case, the scammer will contact you pretending to be someone from a charity organization raising funds. Many senior citizens fall for such frauds as they believe that they are contributing to a noble cause. They will link you with a phony account and ask you to make your deposit. Till this point, you will not even doubt that it is a fake account. Once you make the deposit, only then you will realize that the charity organization is nonexistent.

6. Fraud Credit-Card Offers

Credit card scams are possibly the most popular type of scam out there. This type of scam has been going around for a long time. Credit card fraud is common to both elder people and young adults. Credit card scammers are tech-savvy and extremely smart. They come up with new and innovative ways to loot money from you. This is why it can be challenging for a citizen to keep up with credit card fraud trends. Unless you were an IT expert, you can easily fall for these types of scams.

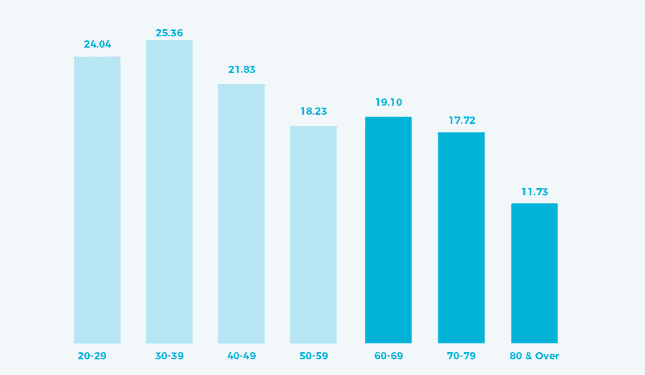

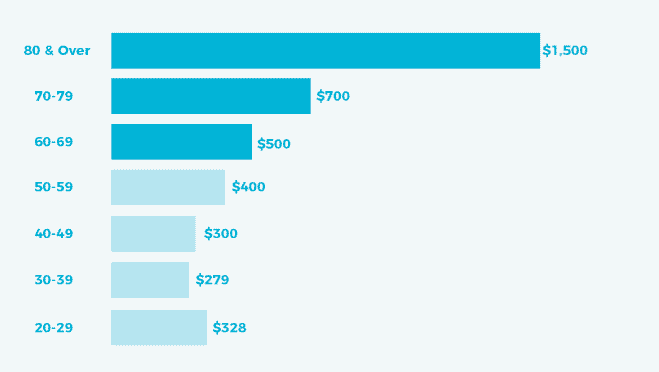

The average victim was a woman between ages 70-79 and she had less than $20,000 in her bank account (source).

7. Social Security Administration Impostor Scam

Social Security admin scams are on the rise, especially with the kind of success rate that people have had with the fraud. Imposters contact the victims and then eventually falsely claim issues with their social security number to acquire the number and then do crimes under that. Most of these imposters tend to scam the old people by asking them to withdraw money from their bank account and then deposit them into other means like gift cards and such for safekeeping.

8. Tech support Scams

Another very common mode of scamming old people is using customer support. The fraudsters call random numbers posing as computer technicians for a specific company to further warn people about risks associated with the different kinds of products they own. They further go on to ask the old people to give them access to their computers remotely and then end up making people pay a large sum of money to get out of the issue.

9. IRS Imposter Scam

While several different types of scams are going around involving telephones, the IRS imposter scam is a fairly sophisticated way of scamming people for their money. They target taxpayers, claiming to be IRS employees, and use fake names and identification to make people transfer money to their accounts. IRS imposter scams are very common in Western countries.

10. Family or Caregiver Scam

Although not the most prevalent, family or caregiver scam does happen. In this type of fraud, the imposters directly call the victim and tell them they are a family member calls, or sometimes they give a reference to their caregiver. Sometimes, the fraud is done by strangers trying to wire in some money to their name, and at other times, actual family members and caregivers are trying to scam the people close to them.

Telephone fraud: FCC Consumer Complaints Center

11. Grandparent Scam

One of the most prevalent types of scams that have been noticeable across the world is the Grandparent scam. This doesn’t involve much but plays around with the heart of the old people. In this, the imposter calls the phone number of the old people and then says something along the lines of, “Hi Grandma! Can you recognize me?” Most of the time, the grandparent on the phone will end up guessing which one of their grandchildren is calling, giving the caller a fake identity to wire the fraud in. Once they have convinced the old person enough, they will ask to wire some money to their account because they are stuck in the middle of a financial crisis.

12. Email Fraud

Although not all the majority of the old people aren’t tech-savvy. So, the internet and emails are the next best stop for committing such frauds and scams with older people. Automated internet scams via emails are very common and a single click on such links can lead you to download a virus to your system that gives the scammers direct access to your credentials, wreaking havoc.

13. Funeral Scam

Scammers aren’t empathetic, which is why funeral scams are pretty common too. In this type, the fraud people go through recent obituaries to get hold of numbers of grieving family memories or spouses, trying to extract money from them either by posing as someone to who the deceased person owed money or by providing funeral services.

Tips to Recognize if Elder Fraud is Happening

The number of elder frauds is increasing with each passing year. Everyone needs to stay aware of these frauds. In this section, we will tell you how to recognize if elder fraud is happening.

Recognizing elder fraud when it is happening to someone else:

- The easiest way to recognize elder fraud in someone else is to check their habit and indications. Sometimes people are embarrassed to admit money loss due to fraud. But it can be seen in their behavior.�

- If you notice any changes in the behavior, you must check the documents. If possible, gain access to the emails and look for fraud emails. Look for different papers like unpaid bills, banking documents, and returned checks.

- Someone who has just been scammed may be depressed or lose mental stability. This is more common in senior people. In some cases, they may not even know when and how they have been scammed. You should first try to find out where they were scammed.�

Recognizing elder fraud when it is happening to you:

- The most common type of fraud that happens is related to credit cards. Therefore, you should always stay updated about it. Make sure you don’t fall for some unexplained credit card emails or calls. Also, if you notice any unexplained charges on your credit card, report them immediately to the bank.

- When you make any transaction, you receive alerts or notifications from your bank. Make sure that you receive these alerts on time. This way you will know if someone is using your credit card. You should also be aware of the fake alert systems that are created by some credit card companies.

- If you own a credit card, make it a point to check your credit card report every month. Pay attention to every detail including the smallest amounts that you tend to ignore. Such small amounts may indicate fraud services to which you may fall, victim.

How to Protect Yourself From Online Scams?

Unless you stay updated about the ongoing scams and fraudulent activities, you won’t be able to prevent it from happening to you. Not just senior people, but anyone can fall victim to online scams. Here are some tips that you must follow to keep yourself protected from such fraud.

1. Don’t Share Your Personal Information

You should never share your details such as bank account number and card details with anyone online. No matter, how convincing a person or a website appears, you should always stay cautious. When purchasing items from a website make sure it is authentic only then submit your sensitive information like credit card numbers.

2. Don’t Trust Everyone

Let’s be real, not everyone who knows you are to be trusted. Just because some person knows your full name and where you stay, does not mean they are trustworthy, especially when it comes to money-related stuff.

3. Don’t Entertain Unknown Emails & Calls

As already mentioned above, most scams are carried out over emails or phone calls. This is why you should entertain any unknown emails or phone calls asking for your details. Also, you should avoid opening emails from unknown sources, especially the ones that contain links or attachments. You never know what’s in there in the attachment, so it’s better to ignore it.

4. Be Cautious of Charities

No, we are not asking you to refrain from donating to charities. It is a noble thing to do and you should be a part of it. But you need to be careful about donating to charities. Donate only after confirming that it is a legit charity organization.

5. Don’t Get too Friendly with Strangers Online

The internet is a place where you get the chance to meet many people. But sadly, most of them are not to be trusted. If you meet a stranger online, don’t get too friendly with them. If you are there just for social networking, there’s no need to share your financial details with anyone.

6. Don’t Click on Random Pop-up Adverts

When surfing the internet, don’t click on random pop-up adverts that show on your screen. These pop-ups are often scanned techniques. Sometimes, these pop-ups may even contain viruses or malware that may affect your computer. Also, you should set up your PC to install security updates automatically. So if someone tells you you need an upgrade, you know the person is a fraud.

Conclusion

Online scams are becoming more common these days. Remember, your safety is in your hands. If you have any elder people in your family keep a check on their behavior. Ask them if they are facing any such situation. You need to be aware of online scams and the new phishing techniques these hackers use. When you stay updated, you can avoid such scams.